This is the first post in our multi-part series that deep dives into the world of NeSL and Information Utilities. Read our introductory post in case you missed it.

In this post, we'll be covering the "Information Problem" that characterizes the conventional insolvency process.

For this we'll need to first zoom out and briefly have a look at the insolvency process itself.

Wait, hang on. Before we do that we need to zoom out even further and briefly look at the concept of debt itself.

The importance of debt

A debt broadly involves two types of parties:

- Debtor: Someone or some entity who "owes" debt

- Creditor: Someone or some entity who "is owed" debt by the debtor.

In many instances there can be "multiple debtors" or "multiple creditors" for a debt. Then there's the matter of third parties involved like guarantors. But in all these scenarios - the relationship is fundamentally one where "one individual, entity or group" owes "another individual, entity or group" a sum of money.

There are also multiple "types" of debt. But for simplicity's sake we'll be referring to one kind of debt in this series- "financial debt". Financial debt arises out of a transaction where the Creditor gives the Debtor money for the consideration that the debtor will repay the money "along with interest" to account for the "time value" of that money.

Sounds familiar?

That's because the most common form of financial debt is loans.

A significant chunk of economic activity in any economy is driven by loan debt.

Most people wouldn't be able to buy homes if home loans didn't exist. Most people wouldn't be able to buy vehicles if auto loans didn't exist. Most businesses would not exist if it wasn't for business loans. Even consumer goods like refrigerators, TVs, microwaves and phones are purchased with debt these days (what did you think that EMI was?)

Most loans in the formal economy are disbursed by financial institutions like Banks and NBFCs. Both these institutions are super vital for the economy - because they ensure the flow of money available to disburse as financial debt - which in turn gets converted to economic activity.

Banks are even more important. That's because their source of funds largely comes from "deposits" that the public at large - like you and me - make in our bank accounts. Banks also act as the source of funds for NBFCs.

But what happens when a borrower is unable to pay debts back to a Bank or NBFC? What happens when many borrowers are unable to pay back debt?

That's where the Insolvency System kicks in.

The Importance of a Good Insolvency System

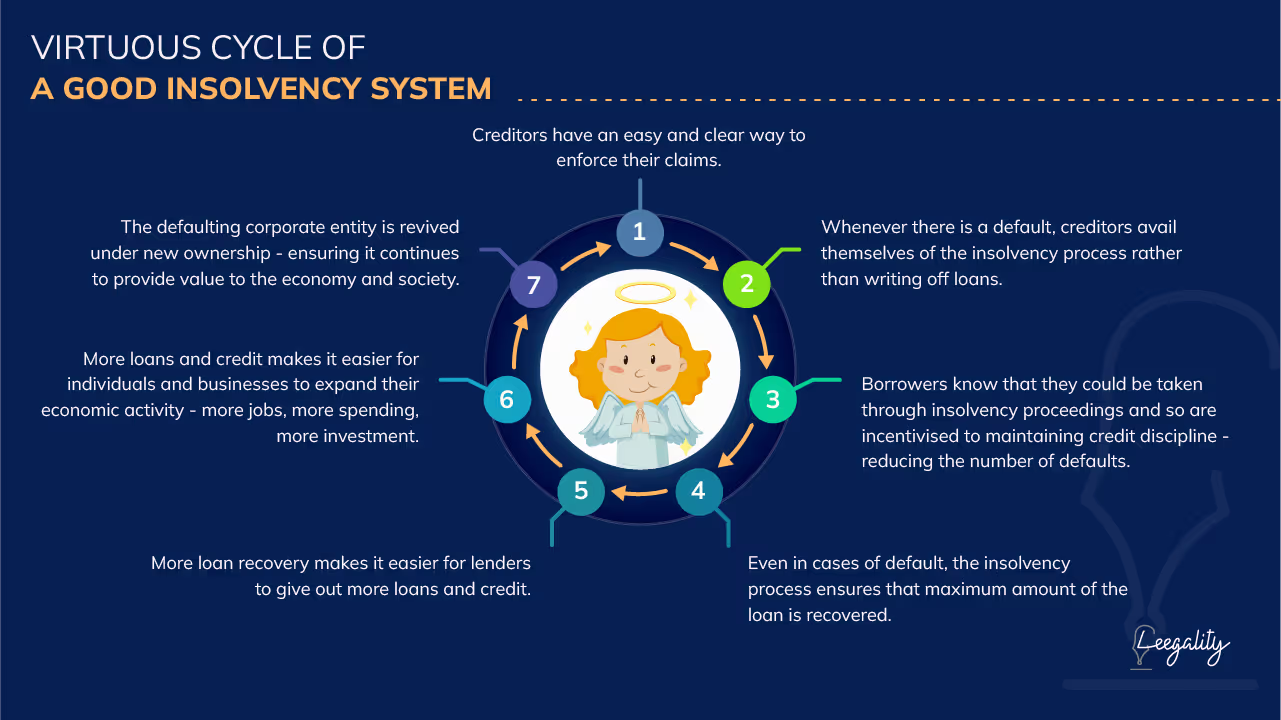

As per the IMF, a good insolvency system - helps enhance the flow of credit, creates credit discipline and provides a way for the economy to “preserve value” from defaulting/sick companies.

Basically a good insolvency system is REALLY IMPORTANT for the health of a country’s debt system - and therefore the economy at large.

The problem with Indian insolvency pre-IBC

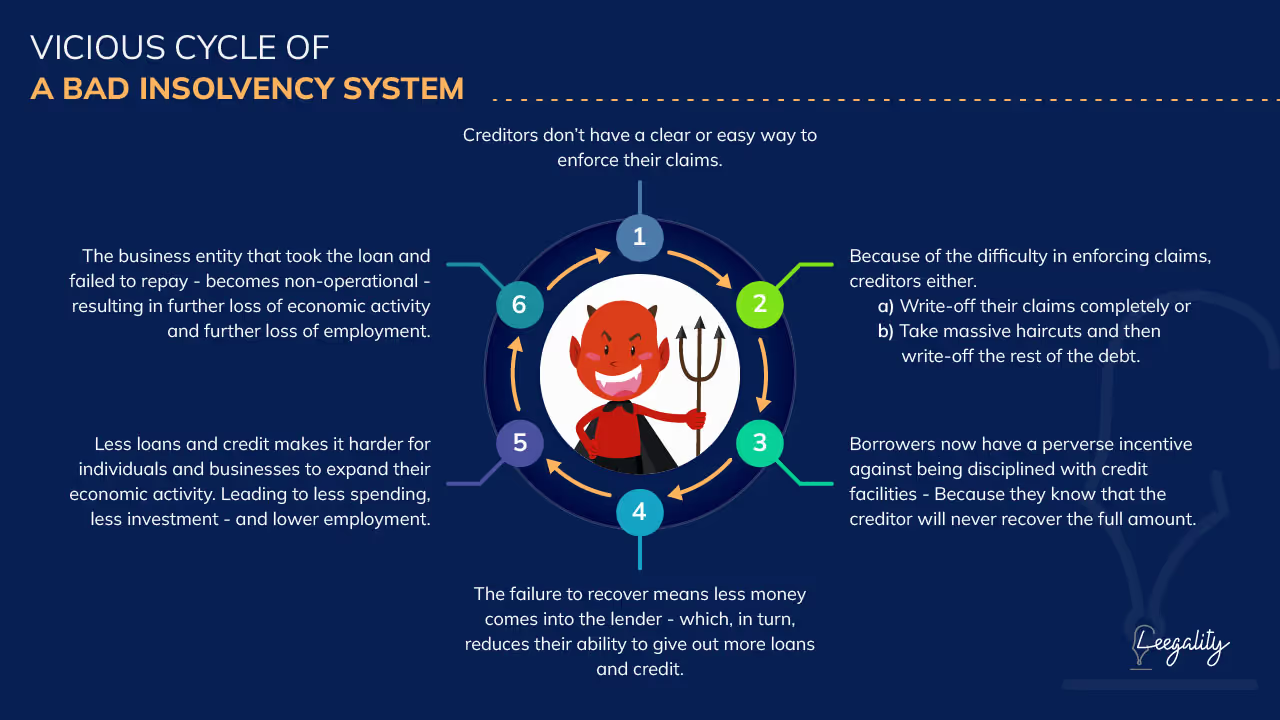

Before 2016, the Indian insolvency system was, to put it very mildly - NOT GREAT.

It consisted of a jumble of complex and ineffective laws with varying enforcement mechanisms - ranging from Tribunals, District Courts and High Courts.

This complex system had three critical problems:

- It was slow

- It had low success rates for creditors

- It lacked proper process to revive defaulting corporate entities

Naturally this also had a spillover effect to the economy. Instead of kicking of a "virtuous cycle", the sub-par insolvency system kicked of a "vicious cycle of debt"

Enter the IBC

In 2016, Parliament enacted the Insolvency and Bankruptcy Code, 2016 - or the "IBC" as it is popularly known as.

Parliament decided that - rather than merely tinkering with the laws here and there - it was time for a complete overhaul.

So the IBC did just that. It provided ONE consolidated process for creditors to enforce debt claims. The new process was designed to:

- Be fast and easy for creditors

- Ensure high success rates for creditors - and thereby increase the general capital available for credit in the economy

- Provide a solid framework for reviving defaulting entities under new ownership - to ensure they continue contributing to the economy

The IBBI, in conjunction with the World Bank have published a detailed handbook on the IBC here.

We won't get into all the details here.

Evidence and Process in IBC proceedings

One of the reasons the pre-IBC insolvency system in India was slow - was the manner in which it dealt with evidence and process in insolvency proceedings.

Pre-IBC the system worked something like this:

- The process did not placed very few limits on the type of evidence that could be produced or the manner in which such evidence could be contested

- judicial bodies in the insolvency system worked as adjudicatory bodies that needed to evaluate the truth and merits of evidence produced before them

- Due to the multiplicity of evidence - each time a particular order was passed on a piece of evidence - parties had an unrestricted right to appeal that order - frustrating the entire proceedings

This system was slow and ineffective because it provided borrowers with a way to frustrate creditors’ claims solely through legal strategy.

The immense frustration often caused creditors to:

- Write off claims completely

- Take massive haircuts in settlement deals with the borrowers

- Fight legal cases endlessly

Under the IBC, the evidence and process system was greatly streamlined and simplified:

- Creditors just had to prove ONE piece of evidence - something showing that there existed a valid debt which was defaulted (in case of operational debt - there is evidence of dispute - but we’ll ignore it for now as we are just focused on financial creditors)

- Judicial body could only act as a verifying authority for this evidence. It could not go deep into the merits of the evidence

- In case of an unsuccessful verdict against the debtor - there was very exceptional and limited grounds for appeal

This system was designed to be fast and easy - with very little leeway provided for defaulting borrowers to escape the clutches of insolvency.

Evidence of Default of Debt

Under the simplified, streamlined evidence process under the IBC - the success or failure of any insolvency petition hinges on whether the creditor is able to provide evidence of default of debt.

How is evidence of default of debt proved? Through information about the debt.

Information about debt can be found in two places:

- Validly executed debt documentation: debt documentation records the terms of the debt, amount loaned, interest rates, payment schedules etc. It acts as the charter document on the basis of which a debt transaction can actually proceed

- Updated credit information: Borrowers repay debt over a period of time. To see whether they have defaulted - you need updated, accurate information of the status of a debt at any given point in time

The Information Problem with IBC evidence

Conventional modes of creating debt documentation and maintaining debt information create problems that cast evidentiary doubt about their veracity.

A) The vulnerabilities with the paper based process for loan documentation

Physical execution of loan documentation is a multi-step logistics and compliance exercise that takes time and is a pain for both the borrower and the lender.

A typical process would involve - among other things - the following steps:

- Printing out the relevant documents (sometimes in duplicate and triplicate)

- The Creditor filling out the relevant information

- Verifying that the information filled in is correct

- Coordinating with stamp vendor to purchase stamp paper

- Coordination between borrowers and lenders to sign the documentation

- Ensuring that borrowers, lenders and other relevant parties sign on all necessary parts of the documentation

- Ensuring that sufficient “proof of authority” like PAN Cards and Board Resolutions are collected from the borrower

- Ensuring sufficient copies are available to all parties

- Maintaining a safe and secure chain of custody for the original documents to be stored safely

- Producing the correct documentation - without any missing or torn pages - before the court or tribunal during insolvency proceedings

This process is a multi-step logistics process carried out physically. By nature, it is prone to vulnerabilities like:

- Damage to documents in custody

- Missing pages

- Bona fide errors in filling up information and document verification

- Missing signatures in critical locations

- Insufficient proof of authority

B) Borrowers and Creditors are incentivised to taking shortcuts when executing the initial documentation

At the stage of executing loan documents - both the borrower and creditor have a common goal - disbursal of the loan as fast as possible.

The time consuming, painful nature of the physical execution process directly contradicts this goal.

As a result of this tension, borrowers and creditors often jointly condone shortcuts in the physical execution process like:

- Lenders leave some columns in the documentation “blank” when the borrower is signing that they will “fill in later”

- Borrowers often agree to collect their copy of the agreement later

- Stamp paper is not affixed at the stage of signing

- Missed signatures are often “ignored” - and collected only post disbursal

These shortcuts often result in the ability to “sow doubt” about the full integrity of debt documentation. As we’ll see later in this article - this has implications for the enforcement of debt.

C) Hard to codify revisions

In the case of loans - especially large corporate loans - borrowers and creditors often revise and revisit the terms of their agreement after disbursal of the loan.

These revisions are often recorded in correspondences - like letters or email. Because of the cumbersome nature of physical execution (mentioned above) - these revisions are sometimes never codified by a freshly executed agreement. And in cases where they are - the revised execution suffers the same vulnerabilities mentioned above.

D)Information and documentation stored in a non-neutral place

The conventional process of debt documentation execution and debt information is a process between two parties - the borrower and the lender.

Therefore any debt documentation physically executed is stored with either of the parties - and a copy provided to the other party. The original is usually stored with the lender.

Similarly whenever a borrower makes a repayment to a loan - this information is recorded in a repository controlled by the lender. And when a borrower fails to make a repayment - the information about this default is again in the same repository controlled by the lender.

Both parties are fine with the lack of neutrality during the good times of disbursal - because their common goal is fastest disbursal.

How debtors exploit the Information Problem

Suppose a borrower defaults on their debt - and the creditor takes them to the NCLT under the IBC.

Now the goals of each party are diametrically opposite (usually):

- The creditor wants to enforce its claims

- The debtor wants to thwart the creditor

Under the IBC, a debtor has very limited room to thwart the creditor. The only slim avenue they have is somehow casting doubt on the evidence of default.

The Supreme Court has provided a potent tool to debtors by holding that NCLTs are bound by the principles of natural justice and therefore must afford both parties a right to hearing.

This gives borrowers an opening to:

- Attack the flaws in the “chain of custody” of the physical documents to cast doubt on the terms of the agreement

- Use the lack of neutrality of the information stored to cast a shadow on evidence of default

Therefore, one often hears arguments in the NCLT like:

- “Your honour, the Bank fraudulently added these terms to the agreement after we had signed”

- “Your honour, these subsequent letters clearly indicate that the Bank and I have already settled the matter under a fresh agreement”

- “Your honour, the record shows that the Bank has improperly recorded the amount I have repaid”

The list can go on and on.

These arguments are given a veneer of respectability through 500 page objection statements and expensive senior counsels being engaged to appear for the borrowers.

At this point you may laugh and say - “sure, debtors can adopt these arguments. But they get dismissed in almost all cases”

And you would be right.

Except that’s not the point.

By employing these tactics, the borrower doesn’t intend to avoid orders of admission (although this is a welcome outcome) - because this is virtually impossible in insolvency petitions filed by financial creditors.

Instead the end goal of the borrower is to protract and prolong the insolvency petition - and delay admission as much as possible.

In my previous avatar as a lawyer I have personally used these arguments and tactics while representing various corporate debtors in financial creditor petitions before the NCLT.

How delays thwart the insolvency process

At this point you may be wondering -"Ok, so some delays happen - what's the big deal. The financial creditors will still get what they want eventually!"

But this fails to take into account one critical fact. In the business of money and debt time is, quite literally, money

Therefore, delays in the process:

- Cost the creditors valuable interest on the defaulted debt

- Deteriorate the value of assets of a company - making the scope of future recoveries more bleak

- Gives the borrower an opportunity to siphon assets of the company to related entities. This is very popular with promoter-led companies - which are the most common type of corporate entity in India

- Allows the borrower to come up with a multitude of schemes to try and circumvent the insolvency proceedings

- Increase uncertainty and doubt in the insolvency system

A 2021 report by IBBI stated that the insolvency process in India takes an average of 459 days. That’s about 280 days more than the stipulated 180 day time limit in the IBC. 190 - if you count the permitted 90 day extension.

So, while the new IBC system is FASTER than older systems in India - it still isn't meeting its own high benchmarks.

Are these delays ONLY caused by the debt information and documentation process? Obviously not.

But will an improvement in the debt information and documentation process help reduce these delays? Probably.

That’s where Information Utilities step in.

----------------------------------------------------------------------------------------------------------------------------

Want to know how exactly Information Utilities solve the Information Problem? Check out our next post.

If you have any questions, comments or feedback - feel free to contact the author at aditya@leegality.com

If you are from a Bank or NBFC that is looking for a fast and easy way to integrate with NeSL - then click on "Get NeSL" in the link below.

.avif)