The RBI has penalized 4 lenders for non-compliant KFS flows. We analyzed various RBI circulars and identified 4 KFS mistakes that led to the fines.

In this article, we will be breaking down each mistake and how to fix it via digital KFS:

Mistake 1: Not providing KFS

An MFI was fined for not giving KFS to its borrower.

This is a super basic and obvious violation. The KFS Circular mandates KFS for all retail and MSME term loan products.

If you have an MSME and Term Loan Product, then you must have a KFS in your process. It’s that simple.

How to fix this via digital KFS?

The solution is straightforward – ensure KFS execution across all branches.

While this seems straightforward, it’s tough to implement at a ground level because you rely on the discretion of your field/branch officers to actually share the KFS. If a branch officer fails to attach KFS for even one document, it puts you at risk of fines and reputational damage.

Fortunately, in a digital KFS process, you can fully eliminate discretion and ensure a mandatory, automated attachment of KFS:

- Workflow configuration (One-time setup on Leegality dashboard): Loan Agreement workflow, contaning KFS and Loan Agreement, is configured. This is a one-time setup for the document execution process, like what documents, no of signers, and eSign type, and runs automatically without branch discretion.

- KFS execution (on branch app)

.avif)

Mistake 2: Not including computation sheet of APR & amortization schedule

An NBFC was fined for not explaining the interest to its customer.

While the RBI’s order does not explicitly mention the KFS circular, this violation could have been avoided if the NBFC had complied with Clause 6 of the KFS Circular:

The KFS shall also include a computation sheet of annual percentage rate (APR), and the amortisation schedule of the loan over the loan tenor. APR will include all charges which are levied by the RE. Illustrative examples of calculation of APR and disclosure of repayment schedule for a hypothetical loan are given in Annex B and respectively.

Clause 6 is important because it actually defines what the full KFS kit must contain.

The KFS kit is not just the template in Annexure A of the KFS Circular. It must also contain a computation sheet of APR and amortization schedule.

_page-0001.avif)

How to fix this via digital KFS?

Your KFS template configured in your LOS/LMS or document execution platform must include Annexure A and a computation sheet of APR and amortization schedule. Just the Annexure A template won’t be enough.

RBI has, helpfully, provided examples of how these additional attachments should look in Annexure B and C of the KFS Circular, as specified in the RBI guidelines.

Mistake 3: Incorrect or missing details in the KFS

A major NBFC was fined for not disclosing the co-lending arrangement in the KFS.

Even this violation does not directly mention the KFS Circular. However it would have been prevented had the NBFC complied fully with KFS requirements.

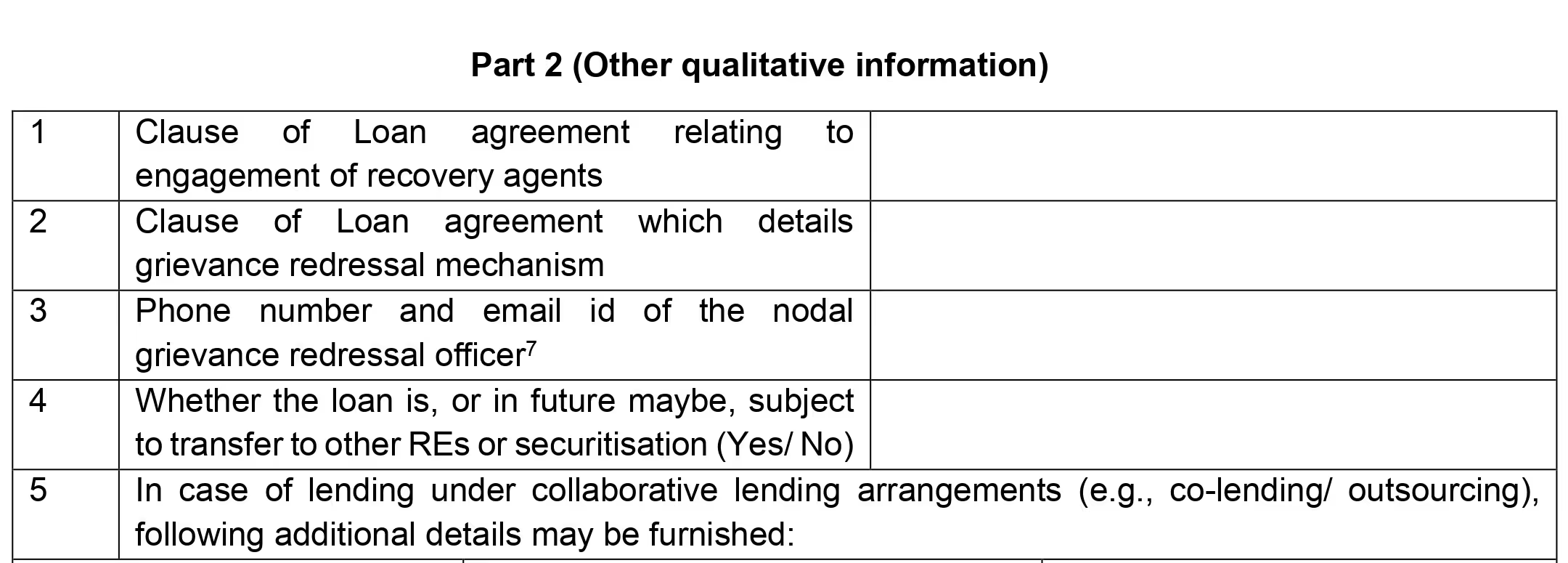

Here’s a section from the RBI’s KFS template:

See Sl. No. 5 of Part 2 above - there is a clear need to disclose co-lending arrangements in the KFS itself.

How to fix this via digital KFS?

You will need to configure mandatory fields in your KFS template - and ensure validation checks that prevent the KFS process from continuing unless mandatory fields are filled in.

Where you implement this validation check depends on which software in your journey is generating the final KFS:

- If you're creating KFS in LOS/LMS and then passing base64 PDF to your document execution platform: Your validation check would need to be at the LOS/LMS level. Your LOS/LMS should - basically - not be able to generate a final KFS in the absence of a mandatory field being filled in.

- If you're creating KFS in the document execution platform: Your document execution platform must prevent an eSign link from being created unless all mandatory fields are filled in.

Mistake 4: Not translating the KFS into vernacular languages

A major NBFC was fined, and one of the reasons cited was - KFS was not in a vernacular language.

The KFS shall be written in a language understood by such borrowers. Contents of KFS shall be explained to the borrower and an acknowledgement shall be obtained that he/she has understood the same.

Clause 4 of the KFS Circular require KFS to be written in a language understood by the borrower.

English will not work, because India is a multilingual country, with only 15% of the population being comfortable with English.

How to fix this via digital KFS?

.avif)

.avif)

Leegality has helped 20+ lenders implement compliant digital KFS. Experience an interactive KFS demo.

.avif)